Start Tracking your Net Worth

What is and why Start Tracking your Net Worth? Net Worth is stated to be the sum of all your assets less your liabilities. So, the value of all your stuff including measurable assets like bank balances, an estimate of the value of any real estate you might own, approximate value of your car if you have one. Of course, Some assets have very firm values and some you may need to guess at. Your liabilities are typically well defined, just look at a recent statement and you will surely see your credit card balance. Do your best, this is an estimate.

The top reasons to Start:

- You measure how you are doing toward goals like retirement or saving for a house.

- See how you compare to others your same age.

- Determine if your savings and investment plans are working.

- Monitoring your debt and watching it reduce or grow over time.

- Projecting out in the future for 1, 3, 5 years or more to see where you hope to go.

- To also look back and see your progress.

- Written goals are far more likely to be worked on and achieved.

Start Tracking Your Net Worth now with a Statement

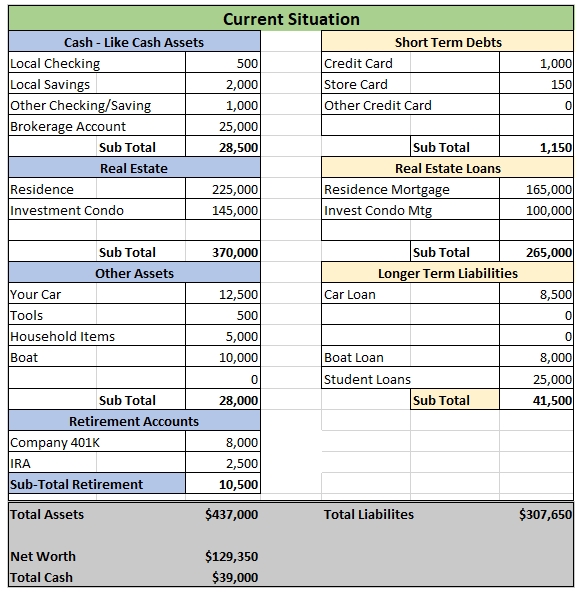

We recommend you start a net worth statement in Excel or Google Spreadsheet. It will look some thing like the image below. Of course, The example we use is just a typical person or couple who own a home, held on to their first condo and rent it out. They then began by starting a budget, saving for retirement with a 401K at work and have some additional savings.

Most of the entries are self-explanatory. They in fact might not look anything like your situation. For example, if you live in a city you might not own your home, might not own a car and owning a boat might seem a little silly. The basic format will however look the same for everyone. All your assets should be placed on the left. All the liabilities should be listed on the right. Then, total the two sides, subtract the liabilities from the assets and see where you stand.

You might even be in a position where you have a negative Net Worth. Do not let this concern you especially if you are young and have large student loans. In that case remember you should have an increased lifetime earning potential that we would not list as an asset but really is a huge asset over time. The important issue is to start doing this at least annually. You want to track progress over time.

Let’s Review an initial look at Tracking Your Net Worth

So, let’s review this Net Worth statement to pick out some important points. We don’t see a tremendous Net Worth here yet for this person as it is $129,350 which for a 30 year old is really very good but might not be for a 60 year old. That said, all situations are different as if this is the situation for a 60 year old who in 2 years will be collecting a $6,000 a month pension then it is perfectly good. The statement shows solvency, and some very good things are happening. Here are some of the good elements and they are especially good if this is a 20-30 something aged person.

The Really Good Aspects of This Financial Picture

- Owns great assets, 2 pieces of real estate.

- Savings programs look to be in place and likely growing – Brokerage account, 401K and a small IRA.

- This person is hopefully enjoying their boat and while they don’t drive a really new or expensive car they are having some fun! Part of real abundance is also having some fun.

- A fair amount of debt in total but the real estate debt is good debt and the assets are not over leveraged.

- Minimal bad debt on credit cards that is likely paid in full most months.

- This person believes in tracking your net worth!

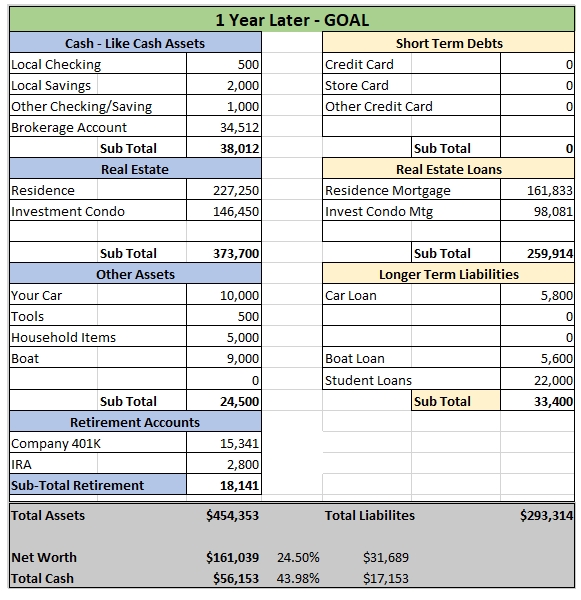

Progress is made after tracking your net worth in one short year is excellent. Each piece is going well and working together. Mortgages are being paid down. Short-term debts are being paid off. This person has a great base of assets that grew naturally, their tenant is paying off one of the mortgages and helping to fund a robust $500 per month savings program. The 401K is being maximized and the company matching of 3% is a big help. A Net Worth growing around 25% in a year is considered excellent. Well done! This person is on a great track doing exactly what it takes to build some wealth and abundance over time.

Year Five of Tracking Your Net Worth

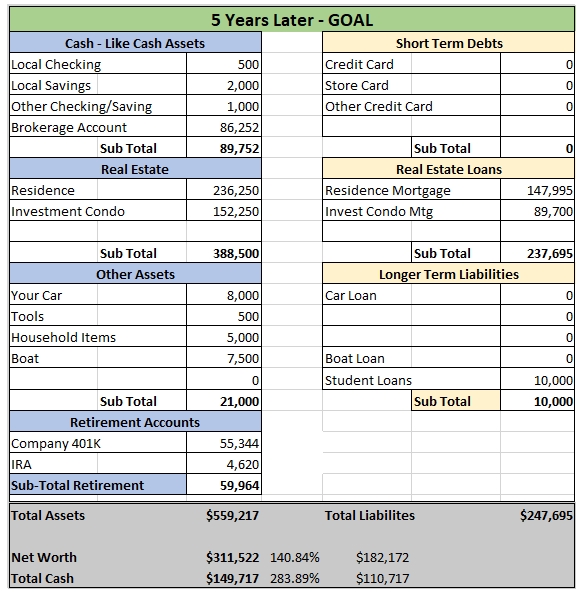

Let’s see what happened over a total of 5 years. All the original savings, debt payments, appreciation and depreciation were kept the same from the first year. Nothing changed just keeping up the good work and letting time and good savings habits work.

Look at the excellent progress! In just 5 years these finances have really grown. 140%+ growth in Net Worth, almost 300% growth in cash and debt is trending down nicely. Tracking your net worth after Year 5 is shown as a goal since it is an example but these types of results are not unusual. Net Worth growth like this is made possible by using simple methods of saving, owning a variety of assets, taking advantage of a company 401K plan and not accumulating debts. Bravo!