Starting a budget is a very great first step in controlling and watching your income and expenses each month. Your budget is like a financial road map for you or your household. On the left side list your income(s) and on the right side list all your expenses. Simple!

The word budget means to allocate and plan. Planning should mean allocating money for expenses that do occur each month like your rent or mortgage. You will also those expenses that don’t occur each month but you know are coming. These could be items such as automobile repairs and non-monthly payments. So, you should always budget for emergencies and other expenses that inevitably happen. Many expenses can be estimated and planned for. That is the goal!

What does Starting a Budget Accomplish

- Shows you where your money is going,

- Shows you where you are potentially spending too much money.

- Give you areas to work on including places to cut so you can add to savings.

- Gives you an ability to model out what some systematic savings will do for your monthly cash flow.

Starting a Budget – Add Your Income

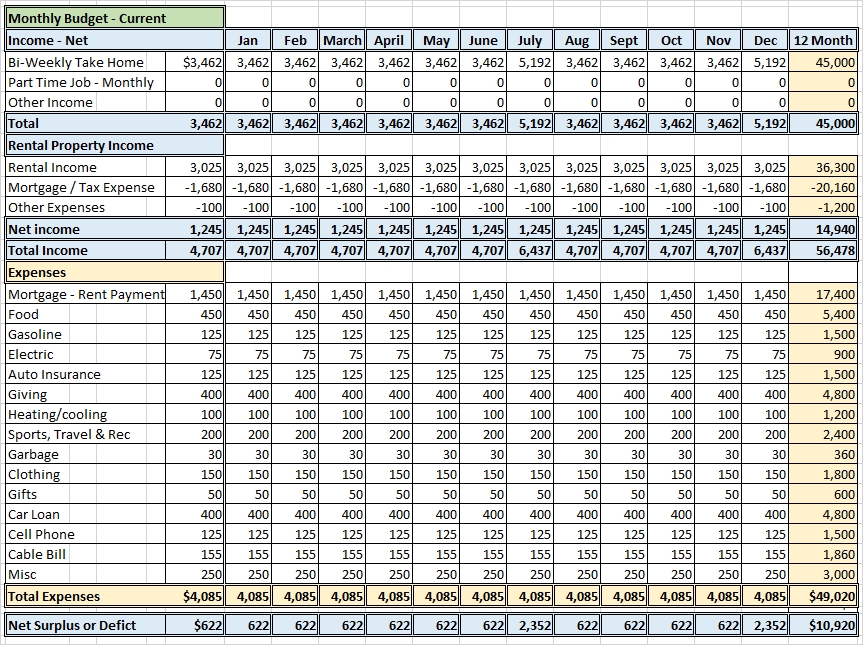

Likewise, on the income side your income may not be exactly the same each month. People who are paid biweekly, generally have very predictable income. They however don’t receive two paychecks per month they receive 26 per year. So, two months of the year they have an extra paycheck.

For some, they have a base salary plus some type of incentive pay such as commissions or bonus. This person would then have to estimate several months out or annually. These people don’t always know in advance what their income will look like. People who are paid by bonus or commission often seek to live monthly on their base salary. They try to use bonus income for other expenses. These could include extra savings, vacations and larger purchases. It is highly advisable if your income varies each month, to keep more in reserve for lower income months. Less predictable income may mean you unexpectedly run dry some months. So, you should have extra cash available, even more than the steadily salaried person.

Remember, even after starting a budget it will evolve as you understand it better and make changes. We want to begin with what is actually happening now in your life. If you look back a few months you can make some fair averages as you start to prepare this for both income and your expenses. Let’s start at the top and look at income as if you were to take a spreadsheet and make 12 columns for monthly income you can forecast out in advance.

Include All Your Income

If you are paid biweekly, find your pay dates for the year to see where the two extra payments come each year and lay this out as well. In addition, you would add any other types of other payments you might receive throughout the year such as part-time income, money you receive for rents, money you expect to receive from a tax return and so on. At the bottom of this column would be the total amount of money you expect to receive per month and then you could total it across and come up with the amount of money you will receive per year. (See the example below)

Starting a Budget Then Keep Refining

List your expenses

Below or next to all of your income each month, you are going to want to start listing all of your expenses. Typically a person’s largest expense is their housing cost so this is either your monthly mortgage or rent. List food, utilities, cable bill, entertainment, cell phone bill, car payments and student loan payments. Now include payments on any other type of debt such as credit cards, car/personal loans and so on. Go through your checking account register and look at the last three months of all your payments. Try to get an average monthly cost for each expense so you can list them all in your budget.

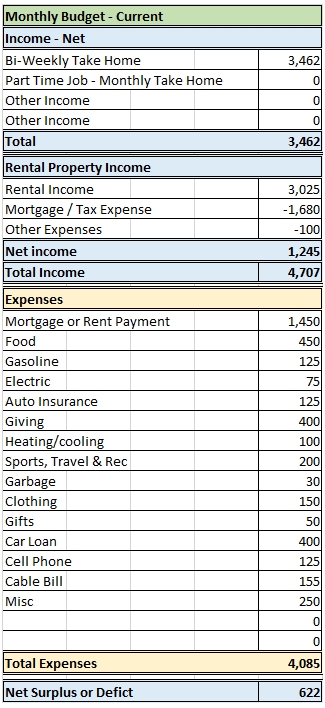

What you should have on a sheet of paper should now look something like this on the left.

Next we will do this for an entire year all the way across your spreadsheet to show expenses. You should also try to show any variations you expect throughout the year. For example, you may spend more money in the winter for heat or more money in the summer to cool your house. You should try to forecast all your income and expenses early in the year. When starting a budget you should try to plan 6-12 months in advance. Doing this each year and by the month so you have an annual plan. This becomes a place to start improving your budget. You also now have a quick way to look for places to reduce expenses and a way to start to forecast your savings plan.

Full Year Budget

At the very bottom of your spreadsheet you should have a total of your monthly and annual income and expenses. Subtract your expenses from your income and see if your budget is balanced. This is the moment of truth. So you will see, if you are running a deficit or hopefully have extra cash flow available for savings and investment.

The hope is that you have more income than expenses! If you do not, it’s time to take a serious look at the money you are spending. In another section, we can also look at the money you are earning. If you are a typical salaried person you should also see two months with an extra paycheck. This could be a source for saving unless you have been absorbing the extra money like catching up on credit card balances.

If you have gotten this far, congratulations! You are being very proactive starting a budget. You are now on the way to getting your finances on a better trail! See our other articles on budgeting such as Budgeting Go Deeper to increase your understanding and skills in personal money management.