Our hope here is to really answer the question is M1 Financial a good investment account for you.

Initially we wrote about our Review of M1 Financial so please start there. Now a few month later we can better answer if M1 Financial is a good investment account. Since we have an M1 Financial account set-up and use it, this is all from direct observations of M1. We are not making recommendations for what you should do or how to manage your M1 Financial account. Please make your own informed decisions. Here are some first hand experiences and thoughts to share with you. You may click here to investigate further M1 Financial

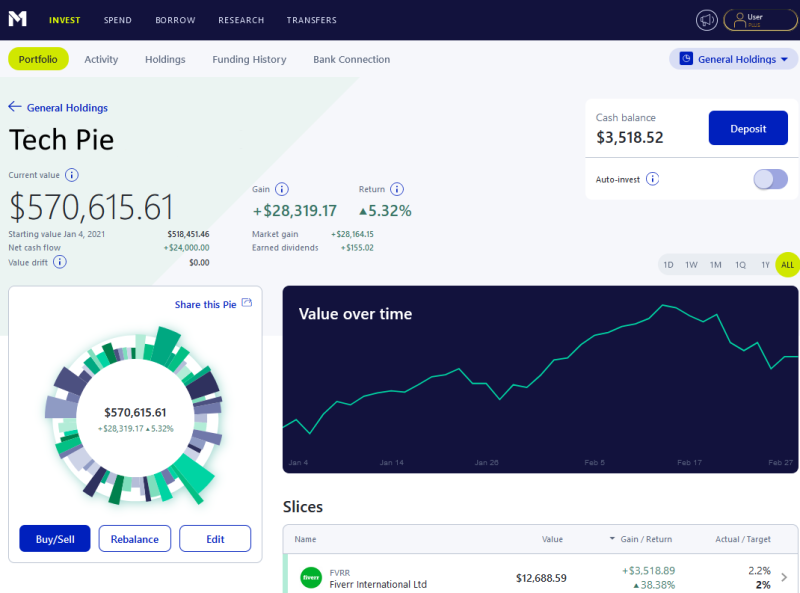

M1 holds your investments in “Pies”

M1 Finance is a good investment account because of the way it is set-up. To start you will have a portfolio which encompasses all of your holdings and then M1 has designed a system where you will create “pies” that are all part of the overall portfolio. Each Pie is therefore a slice of your portfolio and each stock or ETF in your Pie is also a slice. You could have just one pie or several pies, probably as many as you would like.

Think of pies as sub accounts or buckets of your total portfolio. You might divide your holdings up into different pies for a variety of reasons. For example, you might have a pie that you choose to hold tech stocks in. That pie you could hold any number of stocks that you classify as tech stocks. You could call it “Tech Stocks”.

Some examples of M1 Financial Investment Pies you might set-up

- Dividend Stock Pie.

- Tech Pie – watch to see if your tech stocks outperform another Pie.

- An ETF Pie – early investors may prefer ETF’s and might want to direct new savings to this area.

M1 Finance does a very good job of allowing you to balance the shares you hold within a pie to percentages. For example, you might want to have 10 stocks in a pie called Tech Stocks and have each stock represent 10% of the total pie. You would first purchase those stocks in dollar amounts that each equal 10% of the total. For example, you might have a total value starting in the pie of $1,000. Then you would buy $100 each of each of the 10 stocks for a total of $1,000.

Auto-Investing – Is it for you?

You may or or may not select to have M1 Finance auto auto-invest into this pie. What this means is any new funds coming into the account will be invested based on the percentages you have each security allocated to. For example, if you had 10 securities each with a 10% allocation any new funds would be purchased at 10% per security. What will happen over time is some securities will do better than others, if you wanted to keep each at 10% you would want to have M1 Finance re-balance your Pie. This is a one click option. Easy!

Is M1 Financial a good Investment account if you want to invest automatically?

M1 makes investing fully automated. This is great so that you don’t have to spend your time on a day-to-day basis adjusting your investments. First create your Pie(s). Then determine the Stock or ETF allocations you want in each. Decide if you want to auto-invest and let it run. You may set-up auto deposits or add more money manually. When deposited, your new money will be allocated automatically based on how you set up your Pie(s). You can certainly change your allocations as well.

The one potential downside of this is that you may want to buy more of your winning stocks. This is a strategy many advisors recommend. The reasoning is a stock that has done well is more likely to continue to do well. For this reason, you might not want to auto-invest new funds coming into the Pie(s). You should carefully consider re-balancing your stocks. Re-balancing could be killing off securities that have grown and may continue to grow.

So, remember, stocks that have done well, often to continue to do better than stocks that have not done well. This is true when you consider looking at stocks that have doubled, tripled, or become 10 times what they were. For example, try and find a time when you should have sold Apple or Home Depot? These may be the stocks you really want to add money to – not sell. This is a decision you need to make yourself but please be careful with re-balancing.

Re-balancing your M1 Pies

Re-balancing a group of stocks will prevent you from becoming way to concentrated in 1-2 stocks. You may sometimes have to lighten up on some of your winners. A strategy you might use to initially set up your pies with M1 Finance is by dividing your amount of initial investment into 1%, 2%, 5% 10%. allocations. You actually have to do to set up a Pie on M1 but you can choose not to auto reinvest or re-balance. An option, give stocks time to run, manually invest new funds and use your M1 account like a more traditional brokerage account. This is of course an option with M1 Financial as well. Use caution and get advice and several opinions before selling off a strong performing stock or ETF.

M1 offers Expert Pies an ETF Alternative

Is M1 Financial is a good Investment option for those who want to pick their own stocks or those who want to own funds. The answer is Both! There is a lot you can do with M1 Financials’ pies. You can create your own pies or chose from M1’s wide selection of “Expert Pies”. Pies can be created to mirror sectors of stocks or industries. You also might create a pie of tech stocks or use one of M1’s NASDAQ based Expert Pies. The large selection of Expert Pies that are pre-made for you is an easy way to diversify and buy a couple sectors of the market.

More uses for M1 Pies

Another use of M1’s Pies might be for special savings events. You might have a long-term Pie set up for very long-term goals like retirement. Then also a Pie or two for some shorter term goals such as saving for a house or car. A practical example might be you save $1,000 a month. $500 is going toward saving for a car, $250 toward paying off a student loan and then $250 for retirement savings. Retirement savings will of course go into an appropriate linked retirement account. This is helpful for many people and might be something you find to be a good discipline. Try it in small bites at first.

M1 Financial a good investment account and a low cost place to borrow.

Low cost borrowing is a unique feature with M1 Finance from many of the brokerage accounts that we have reviewed. M1 offers extremely low borrowing rates collateralized by your investment holdings. Just like a margin account that you secure with your stocks and funds but with very low rates. How can you use this feature? For one the rates are very low, as low as 2-3.5% (Currently 2% for plus members and 3.5% for others) which is practically zero with no need for repayment or to make regular payments. This could be particularly handy when your portfolio is returning eight, ten or more percent and you’re only spending 2% to borrow your own money.

What this allows you to do is to plan something like a large purchase of a car pay it down, within 2, 3, or 4 years and not disrupt your investments. Typical your investments are going to yield much higher than 2% per year especially over several years thus you’ve used your own money to buy the car. You benefit from the very low rate and you are still making good returns on your investments. You avoid being tied to a particular repayment schedule. Be aware however that you bought a car that is depreciating in value, you are using up it’s useful life and you should be paying down what you borrowed. If you are regularly investing you can also make the choice to pay down the loan or let it run by investing instead. The flexibility is excellent.

M1 Borrow is a great cash flow tool.

We like the ability to borrow against some of your own money. Borrowing is collateralized by your securities and so a cash withdrawal does not disrupt your investments. For example you might be saving $1-2,000 per month or $12-24,000 per year but want to do make a home improvement in the spring. You could borrow the $5,000 you need early in the year and just continue to invest $1-2,000 per month. You can pay down the M1 Borrow and still invest regularly. Not disrupting your overall investment discipline is better and you get your home-improvement done at the time of the year when it’s best.

Some people might say I’m borrowing my own money, why not just sell some stocks? Selling an investment has some downsides as it may trigger a capital gain. This will cause you to have to pay gains tax only to have to come back and re-buy those stocks again. Better to stay with your savings and investment discipline.

Use M1 Borrow carefully and go slow at first.

If you can stick to good practices borrowing some of your own money as you need it and replacing may help you meet some of your financial goals. This can be a wise strategy, especially at an interest rate of 2%. What we do not suggest and is for experts only is using borrowed money to buy stocks and funds. Inevitably markets will take some big and unexpected downward correction and at that moment in time all anybody would wish is that they have more money to buy more stocks or ETF’s. That is not a time to have a large amount of your investments borrowed against and could trigger a margin call. In a margin call your stocks have decreased, you reach a % of borrowing limit and you must either add cash to your account or sell stocks and a low price.

Instead use small percentages of your portfolio’s value to smooth out rough cash flow, pay down higher rate debt and to keep up steady additions to your investments. You might have for example a portfolio with a value of $100,000 and use just 10% or $10,000 to pay off some higher rate debt. This seems wise and if you keep up good monthly savings and investment you should do better than you would have. Saving a few hundred of dollars a year in interest just makes sense!

Fractional share buying makes M1 Financial a good investment account.

If I could only have one great feature it would be the ability to buy fractional shares. M1 Finance offers the ability to purchase shares of stocks based on a dollar amount not whole numbers of shares. This is fractional share buying. This practice is particularly helpful for people who prefer to invest amounts of money, not purchase numbers of shares. It is also great for the smaller investor who has $1,000 at a time to invest or less and wants to buy into many stocks not just one or two. Almost all investment advisors recommend you maintain a good degree of diversification.

A strategy might be to take $1,000, put it into an M1 pie, and divide the $1,000 out across 20 stocks at $50 each. Most financial advisors are going to advise you to own at least 25 if not up to 50 or more different companies. So, buying shares in small amounts across many companies has generally proven to be a much better strategy. Trying to pick just a couple or even one winner from all the many stocks that you could buy.

In the past you would’ve had to buy whole shares of each stock and with some stocks being $500 per share or much more this would keep a small investor out of certain companies. Now with M1 and a few others they could just buy fractional shares in companies with high per-share prices. If you’ve never done this you will really learn to appreciate investing in dollar amounts versus numbers of shares. You can build yourself some very nice pies on M1‘s platform using fractional shares.

Conclusion

We will write again about M1 as we continue with them and as they may make changes. The overall experience with M1so far has been exceptional. M1 is an excellent tool for both the early investor and the experienced. The question, is M1 Financial a good investment account after a few months is still a resounding Yes. Want to see more or open an account, M1 Financial

We have discussed our personal experiences which should not be considered personal investment advice. Consult with an advisor or many other sources before investing. Your finances are at risk, chose wisely. We wish you well on your personal Trails to Abundance.